Health Insurance has become a necessity today more than ever before. While healthcare costs have been rising for the past few years, the COVID-19 pandemic has made the need for health insurance more pronounced than ever before.

Medical procedures, planned or unplanned, are by nature stressful. The cost incurred during the treatment should not add to the stress. Moreover, it is far from ideal if your financial situation influences the kind of treatment that you are opting for your loved one.

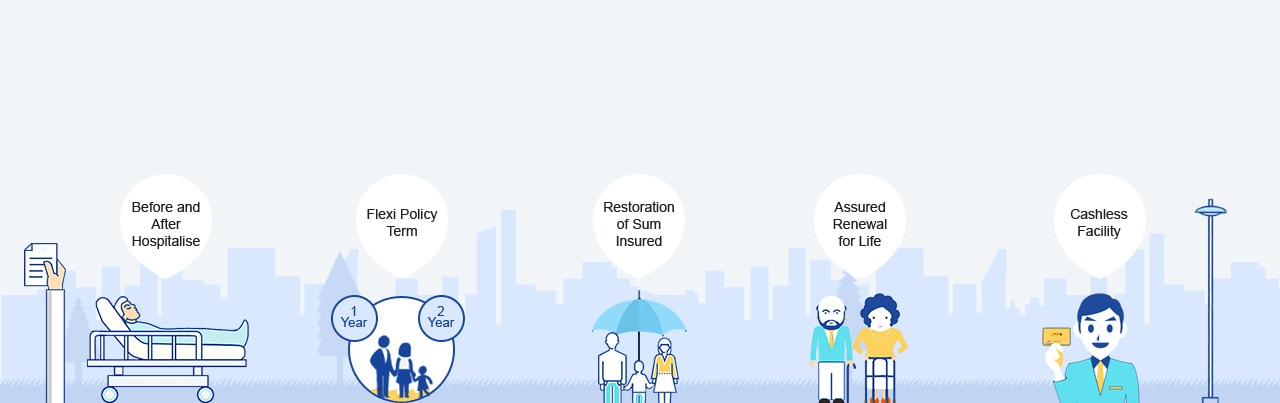

At Liberty General Insurance (LGI), we have crafted Health Insurance policies that take care of hospitalisation and treatment costs to lessen the blow brought upon by an unforeseen accident and illness.

We reward you with a free health check-up after two years of continuous policy renewal with us irrespective of the policy's claims.

If you find a policy unsuitable to your needs after purchasing it, we offer a free look period of 30 days to request a policy's cancellation.

Your sum insured automatically increases by 10% of the basic sum insured for every claim-free year. This benefit can go up to a maximum on the insurance amount.

We at Liberty General Insurance (LGI) ensure that you have the most hassle-free experience when it comes to dealing with a sensitive issue such as health insurance. We draw our experience and competence from Liberty Mutual Insurance Group, which was founded in the year 1912 and now has over 900 offices over the world. Under Liberty Mutual's supervision, we intend to build a customer-centric business to address the distinct needs of individual and corporate customers.

Liberty General Insurance Ltd. is a joint venture between Liberty Citystate holdings PTE Ltd, a group company of US Headquartered Liberty Mutual Insurance Group, a leading multinational property and casualty group, Enam Securities, a privately owned and managed firm that makes long-term investments in listed companies, as well as backs entrepreneurs building valuable private companies and DP Jindal Group, an industrial conglomerate.

Liberty India General Insurance commenced operations in 2013 with the aim of providing comprehensive retail, commercial and industrial insurance solutions. The company has an employee strength of 1200+ over a network of 110 offices in 95 cities across 29 states. Its partner network consists of about 5000+ hospitals and more than 4000+ auto service centres.

Health insurance is a type of insurance that protects you and your family from unforeseen medical emergencies. It covers medical treatments or surgical procedures and can also cover the cost of doctor consultation, prescription drugs, and even post-surgical care. In other words, health insurance shields you from the financial strain brought by a major illness or a severe accident.

Health care costs have been increasing over the years and can often amount to several lakhs if it involves complicated surgeries or long-drawn-out treatments for diseases such as cancer. In such cases, the treatment itself can threaten your way of life by eating into your savings. If an illness hits you or your family member early in your life, most of your earnings will go into financing the treatment, leaving you very little to save for your future. It is not just the treatment or the expensive surgery but the regular care that the patient needs, in some cases for life, that adds to the cost. Regular care includes the cost of prescription drugs, doctor consultation, physiotherapy, follow-up health checks, and regular diagnostic tests.

All the above compounds the stress and difficulty of a severe illness or an unforeseen medical condition. With a comprehensive health insurance plan, you won't have to worry about financial difficulties and focus on getting the right treatment for your loved one, irrespective of the cost.

The general principle of insurance is to shield you from the uncertainties of life. While life insurance provides a financial buffer to your family if you lose your life, health insurance provides you and your family a cushion to ease the burden of cost in the event of a medical emergency.

When you are looking to get a good health insurance plan in India, there are a few things that you need to take into account before zeroing in on a policy:

Evaluate your insurance provider:Check your insurance providers' financial strength and claim settling capability. See if the provider and the policies have good ratings by industry experts and also check customer reviews.

Check for the network of hospitals it covers:his is a crucial aspect to check as your insurance would be useless if you are admitted to a hospital that doesn't recognise the policy. Make sure that the insurance provider has the widest network of doctors and hospitals available for treatment. Check all the hospitals in your city and especially those that are in the vicinity of your home and your office.

Waiting Periods:Always check health insurance policies and medical insurance schemes with lower waiting periods. Your policy doesn't get activated until this period is not completed; hence the period must be as short as possible.

At Liberty General Insurance, we believe the time is precious and are committed to not only ensure that your claim is settled at the earliest but also to render support and be by your side in your hour of need.

How to register a claim?

To register a claim, please follow the below options:

Here is an indicative list of documents required for all kinds of claims:

In-patient Treatment/Day-Care Procedures

Road Traffic Accident

In Non-Medico legal cases

In Accidental Death cases

For Death Cases

Pre and Post-hospitalisation expenses

Ambulance Benefit

Health, medical emergencies, and health insurance are not priorities for young adults. The next new mobile phone or gadget, travel, and other more interesting things take precedence in their lives. However, keeping an eye on the future and securing it has long term payoffs.

Here are some reasons why young need health insurance.

Ever-increasing cost of healthcare: In India, the cost of healthcare has been on the rise and will continue to rise in future. Healthcare inflation increased from 4.39 per cent in 2017-18 to 7.14 per cent in 2018-19. Purchasing health insurance when one is young makes healthcare affordable when they are older and need it most. Insuring at a young age makes premium payments easier as responsibilities are lower, such as children care, home loans, parent care, etc.

Reap the benefits of better coverage for lower premiums: The premiums for young health insurers are low because there are no pre-existing health conditions. Purchasing healthcare gets more challenging with age. The range of plans and the extent of coverage available to the young insurer is also vast. Some plans cover OPD consultations, short procedures, vector-borne diseases, and even maternity expenses. In this day and age, jobs aren't secure. Besides, many people turn to self-employment, business or freelancing when middle-aged. A young insurer can avail of more comprehensive plans that provide higher security in case of unemployment or disability due to illness or accidents.

Waiting period? No problem: All health insurance policies have a waiting period of one to three months before the insurer can make any claims for medical problems. As the chances of any significant health emergency are lower when one is young, this waiting period is inconsequential.

Make the most of bonuses: Health insurance plans offer a no-claim bonus each year. If one starts accumulating the bonuses at a young age, they can be a blessing in case of medical emergencies or when the insurer is old and needs medical attention.

Enjoy the tax benefits: Premiums payments for health insurance are eligible for tax deductions. Thus the burden of paying premiums is reduced for the insurer. Younger you are, the longer you can enjoy the tax benefits of health insurance.

There are a lot of misconceptions about health insurance and the way it works that often leads to problems at the time of claims settlement. Let's see some of the major myths about health insurance:

I am young and healthy, so I don't need health insurance: A common misconception among people across the world is that the young are all healthy. But statistics from the World Health Organisation (WHO) show otherwise. Approximately 2.6 million young people between the ages of 10 and 24 die every year, and many more suffer from illnesses because of environmental and lifestyle reasons. The options available to them and their choice of lifestyle make them susceptible to both communicable and non-communicable health problems. These health issues can be a result of substance use, injuries, pollution, sexually transmitted infections, unhealthy diets rich in sugars, fat and fast food addictions, work-life balance, and so on. Planning and providing for medical emergencies is essential not just for the middle-aged and the elderly but also for young adults.

Health Insurance is a tax saving instrument: One of the worst things you can do is buy health insurance only to save tax. While the Income Tax Act has a separate section for health insurance, it is to promote the culture of having insurance and not for it to be used solely for tax saving purposes.

My employer provides health insurance, so I don't need one: Most employers today cover their employees through a group cover. However, this may be insufficient, so do check what the terms and conditions are to avail the same. Moreover, if you move from the organisation, you will no longer have the cover.

I am entitled to all policy coverage from Day 1: Most insurance schemes have waiting periods. You must check these before selecting a scheme. In some cases, certain diseases are only covered after a certain time has passed. Maternity plans often have a waiting period of over nine months.

I lose benefits if I don't renew my insurance before the due date: While it is essential to renew your insurance to maintain continuity, you need not worry if you don't meet the deadline. Insurance can be renewed up to 15 days from the due date, and all the benefits will be carried forward into the new year.

There are several health insurance policies in the market, and they seem extremely complicated. It is important to choose the right one before committing to a long relationship with your insurer. At Liberty General Insurance (LGI), we have a transparent system of providing all information about our policies so you can make the right choice.

However, here are some general tips while choosing a medical or health insurance scheme:

Understand your Requirements: At different stages of your life, you may have different requirements or needs. As a young person, you may only need health insurance for yourself or might need to have your parents as dependents. If you are planning to get one for the family, different members may have different requirements. All these need to be kept in mind while selecting an insurance policy.

Assess Coverage Limit:A major mistake that most Indians make is not getting adequate coverage. This can prove to be disastrous, especially given that healthcare costs have been increasing with each passing year. You must inquire about the cost of hospitalisation and the cost of surgeries, etc., before making a rough assessment. Several experts state that if you are living in a tier 1 city, then you should have a coverage of around Rs. 10 lakh.

Buy Health Insurance as soon as possible: As mentioned above, there are clear advantages of buying health insurance when you are young. But this does not mean that you don't take health insurance if you hit middle age. If you don't have insurance, get one as soon as you can to secure your future.

Ensure that you understand the Terms & Conditions: It can't be stressed enough how important this point is. It is not just enough to just read them but also to understand them as a lot of the processes and procedures will become clear. If you don't understand any point, you must check with someone in the insurance company.

Do not furnish inaccurate information:While filling out your application for health insurance, be honest about any health ailments that you may already have. Moreover, if you are a smoker or have other lifestyle habits that may affect your premiums, then do not hide it. All the details furnished need to be correct and true as inadequate information or incorrect information can lead to delayed payment or non-payment of your claim.

Health insurance premiums increase over time. Here are the major factors that play a role in calculating your premium:

Age:It is the most significant factor in calculating your premium. As mentioned above, it is in your best interest that you buy health insurance while you are young as you are less likely to have pre-existing medical ailments; as a result, your premium can be lower.

Medical History:A pre-existing health condition or ailment is one that you already had before opting for your health insurance policy. If you have such a health condition, it may increase your premium. In case there is a family history of a particular ailment such as diabetes, that too could increase your premium. However, do not make the error of not declaring such ailment as it may lead to a claim being denied in the future.

Location:Generally speaking, if you reside in a Tier 1 city, then your premiums would be higher than what you would pay for the same insurance cover in Tier 2 and Tier 3 city. This is largely because the cost of treatment and hospitalisation is much higher in Tier 1 cities.

Body Mass Index:While calculating your premiums, insurance providers also factor in your body mass index (BMI). Those with a high BMI are at risk of a host of ailments such as high blood pressure, joint pains, hypertension, cardiac conditions and type 2 diabetes.

Lifestyle:If you are a heavy alcohol consumer or consume tobacco regularly, then your premiums could be higher as you will be deemed a high-risk individual. While smoking tobacco can lead to respiratory problems, chewing tobacco could lead to cancer. This is the reason why a higher premium is demanded.

Get an adequate sum insured:Several studies and health experts have stated that the majority of Indians that have opted for health insurance are underinsured, i.e. they do not have the cover to meet the expenses in the event of a major illness or a serious accident. This essentially puts them all at risk of financial distress as they may well end up paying a significant amount of the incurred medical expenses from their savings. Factor in all the family responsibilities while keeping in mind other factors like age, healthcare costs as well as location. If you're living in a Tier 1 city, then you need to get a cover of around Rs. 10 Lakhs. In smaller cities and towns, the cover can be slightly lower.

Understand various parameters such as sub-limits, co-payments and waiting periods:Health insurance and medical insurance policies in India have certain parameters that you need to keep in mind before opting for the scheme and understand that ramifications.

Claim settlement process:In the aftermath of an illness or surgery, you should not have to struggle to process a claim and get the reimbursement that is rightfully yours. This is a crucial aspect before choosing any insurance scheme. A convoluted and time-consuming claim settlement process can be mentally and physically exhausting—we at LGI pride ourselves in having a transparent and hassle-free claim settlement process.

Hospital Network of TPA/Insurance Company:Health insurance is useless if you are treated in a hospital that is not covered under your scheme or by your company. Check the list and the details of the hospitals that the insurance company has mentioned. Pay closer attention to the hospitals in your city, in particular those in the vicinity of your home. It is equally important that the insurance company has a vast hospital network

At Liberty General Insurance, we have a range of health insurance plans to cater to different needs and health requirements and other kinds of health emergencies that may arise. Here are our plans:

Liberty Health connect policies have four schemes that offer optimum health coverage at an affordable price.While the plans mainly differ in

This policy provides financial support to surviving family members in the event of the insured person's accidental death.This policy's primary intent has been

Your existing health insurance may not be adequate to cover the rising cost of medical treatments and procedures. Many experts have said that most people in the country are underinsured. Health Connect Supra has been crafted to provide

Accidents, by their very nature, are unpredictable. They can occur anytime and anywhere, without a moment's notice. For such untoward situations, you and your family must have a personal accident cover This type of cover ensures that you and your

An illness or surgery affects the family as a whole. Health Insurance should no longer just be limited to a few family members or the family's earning members. Secure Health Connect Policy ensures that the entire family is protected by offering all the features

Health Insurance policies offered by Liberty General Insurance (LGI) are one of the best health insurance and medical insurance plans in India. The insurance policies have been curated to cater to a diverse set of needs and requirements.

The company hereby agrees, subject to the terms, conditions, and exclusions herein contained or otherwise expressed, to pay and/or reimburse actual expenses incurred in excess of the deductible as specified in the policy schedule. The company will pay for the medical expenses in excess of the deductible stated in the Policy Schedule either on a per claim basis or when the aggregate of covered medical expenses exceeds the deductible applicable on a policy per year basis depending upon the plan opted. However, our total liability under this policy for payment of any and all claims in aggregate during each policy year of the policy period shall not exceed the sum Insured, and reload sum Insured if any available to the Insured and stated in the policy.

Our health insurance policies cover the following aspects:

1. In-Patient Hospitalisation Expenses

The company undertakes to indemnify the insured person against any disease or illness, or any injury during the policy period. Moreover, if such a disease or injury shall require any such insured person, upon the advice of a duly qualified physician/ medical practitioner to incur in-patient care expenses for medical/surgical treatment at any hospital/ nursing home in India, towards following expenses, subject to the terms, conditions, exclusions, and definitions contained herein or endorsed.

2. Pre-Hospitalisation Expenses

Medical expenses incurred during the policy period (for the period as specified in the schedule of this policy) immediately before the insured person was hospitalised, provided that:

3. Post-Hospitalisation Expenses

Medical expenses incurred during the policy period (for the period as specified in the schedule to this policy) immediately after the insured person was discharged following hospitalisation, provided that:

4. Day Care Procedure/Treatment

The company will indemnify medical expenses incurred on treatment towards a day-care procedure mentioned in the list of day-care procedures in the policy and as available on the company's website, where the procedure or surgery is taken by the insured person as an in-patient for less than 24 hours in a hospital or standalone day-care centre but not in the outpatient department of a hospital.

5. Loyalty Perk

The policy provides for an auto increase in the sum insured by 10% on the sum insured for every claim-free policy year up to a maximum of 100% of the sum insured if the policy is renewed with us without any break or within the grace period as defined under the policy.

6. Preventive Care

The company will provide below additional benefits which would help in preventing or bettering current Health condition/s. The below services will be provided by Us/Our appointed service provider and can be availed anytime during the policy period, and there are no restrictions on the number of times the facility can be utilised.

A unique offering where the insured person(s) can log in through their individual login ID on the Portal and schedule a live chat with a practising doctor to discuss health problem.

Our Portal provides storage for all your medical documents and reports centrally in one location. With EMRM, you may retrieve your medical documents at your convenience through the internet. This facility provides you with easy accessibility of the documents anytime and anywhere in a secure way.

Relevant and Crisp Fortnightly Publication for Wellness Awareness would be available for you on the Portal.

A) No, it is not mandatory to have health insurance in India. But it is advisable considering the rising cost of healthcare.

A) Health insurance protects medical expenses that occur from sudden and unexpected illnesses or incidents that may require hospitalisation. In the absence of health or medical insurance, you will need to pay for these expenses from your pocket, which can affect your savings. A good medical health insurance policy will help you pay for your medical treatment, including surgeries and thus is crucial for a financially secure life.

A) Health insurance is essential to protect you and your family from a financial difficulty that may arise from a medical emergency such as an accident or an unexpected illness.

A) At Liberty General Insurance, we are well aware of the varying needs and requirements that people may have. We have the following five medical health insurance policies and schemes:

For further information on each of these schemes, please contact us.

A) A cashless facility allows the policyholders to get hospitalised, receive the necessary treatment or surgeries and be discharged without ever having to pay anything from his or her pocket.

A) You can avail of tax benefits under Section 80D of the Income Tax Act, 1961. At present, individuals with medical health insurance who bought health insurance online or offline by any payment mode other than cash can avail of an annual deduction of Rs. 15,000 from their taxable income. This is applicable for payment of health insurance premium for self, spouse and dependent. For senior citizens, this amount is Rs. 20,000.

A) The primary factor that influences health insurance premiums are the age of the policyholder—broadly speaking, the amount of premium for the sum insured increases as you grow older. This is because as you get older, you are more prone to illnesses. The medical history of the policyholder is another important factor that will determine the medical health insurance premium. Lastly, the number of years the policyholder has not claimed insurance is taking into account while calculating the cost of the premium. These are the three main factors all good medical insurance schemes consider while coming up with a competitive premium for any policyholder.

A) You can make any number of claims during the health insurance policy period unless a specific cap is prescribed in any of our policy. The amount of coverage that you can get will be the sum insured under the health insurance plan.

A) Yes, you will need to renew your medical health insurance plan every year.

A) You can purchase health insurance online through our website. When you buy health insurance online, you get additional benefits like the generation of health insurance policy documents instantly.

A) Your employer will only cover your medical expenses as long as you are employed with them. If you change your job, the earlier employer's insurance scheme lapses. Your new employer may well provide you with another medical insurance, but there is a chance that it may not be as good as the old one. Moreover, you may decide to start your venture. In all such cases, you and your family will be left in a lurch if a medical emergency arises. Hence, it is always prudent to have your medical insurance regardless of what your employer has to offer. Your health insurance policy can act as a supplement to the one being offered by your employer. Remember, having too much coverage has never been harmful.

Thanks Mr. Kaushal and Mr. Rajesh Portability for Mr. Rohit's son is accepted by Health Insurance Underwriting Team. This is a lovely example of ''OUT OF THE BOX'' thinking at LGI as Dr. Liji has physically examined the boy after discussing the matter with Dr. Asha and Hemlata madam instead of compelling him to go for X-Ray/MRI. Parents of the boy appreciated the way proposal was tackled as parents and the consulting doctor were not of the opinion of taking X-Ray/MRI of the young boy, as he was fit post hospitalization. Thanks to Underwriting Team for thinking differently.

Thanks Mr. Kaushal and Mr. Rajesh Portability for Mr. Rohit's son is accepted by Health Insurance Underwriting Team. This is a lovely example of ''OUT OF THE BOX'' thinking at LGI as Dr. Liji has physically examined the boy after discussing the matter with Dr. Asha and Hemlata madam instead of compelling him to go for X-Ray/MRI. Parents of the boy appreciated the way proposal was tackled as parents and the consulting doctor were not of the opinion of taking X-Ray/MRI of the young boy, as he was fit post hospitalization. Thanks to Underwriting Team for thinking differently.

Liberty General Insurance offers the best health insurance in India. The plans available with the company are so many...

If you are looking for the best health insurance plans in India, I suggest you go for Liberty General Insurance ...

Liberty offers the best health insurance policy in the market in terms of coverage. I did a very thorough...

I was looking for a health policy that would provide coverage for at least 2 years, so that I wouldn’t have to renew...

I wanted an extra health insurance plan, as the insurance cover from my employer wasn’t enough. I looked at a...

Motor insurance covers several type of vehicle including two, three, and four wheelers. Typical Motor Insurance Policies...

In India, medical costs are increasing at the rate of 15-20%. Unhealthy lifestyle habits and an increasing number of diseases are further adding...

Read More

Getting a health insurance for yourself and your family is as important as adopting a healthy lifestyle. Buying a health insurance cover is...

Read More

By now, most of us know that health insurance provides coverage against expenditure caused by a medical emergency. With rising medical care...

Read More

When you are young and healthy, it is common for people to believe that they are fine and won't require any medical attention, at least not ...

Read MoreRegistration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656

2019 Liberty General Insurance Ltd.

Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013

Trade Logo displayed above belongs to Liberty Mutual and used by the Liberty General Insurance Limited under license. For more details on risk factors, terms & conditions please read sales brochure carefully before concluding a sale.