They say you can’t buy peace of mind. But you can do the next best thing – buy a comprehensive health insurance policy that provides you and your loved ones with the best medical care possible!

When it comes to healthcare, you want nothing but the best – the best hospitals, the best doctors and the best treatments, no expense spared.

Liberty General Insurance’s HealthPrime Connect is a comprehensive health insurance plan designed especially for individuals and families who will accept no compromise on the medical front. The policy is packed with a wide range of benefits. It gives you and your family adequate cover (from Rs 10 lakh up to Rs 1 crore) against infectious diseases, lifestyle-related diseases and critical illnesses.

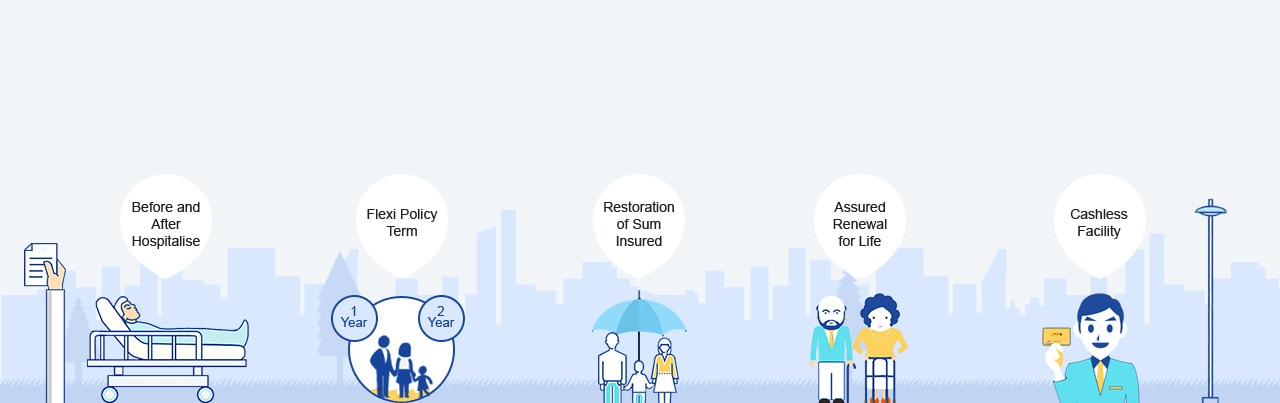

A comprehensive health insurance plan covers a wide range of treatments, including hospitalisation, daycare and OPD. It also provides cover for pre- and post-hospitalisation expenses, including diagnostic tests and doctor consultations.

A comprehensive health insurance plan like HealthPrime Connect is designed with two critical insights in mind:

The best way to safeguard yourself in such a scenario is to invest in a good, comprehensive health insurance plan that will allow you to get the medical care you need without worrying about costs.

HealthPrime Connect perfectly fits the bill. With insurance cover ranging from Rs 10 lakh to Rs 1 crore, and benefits like no copay, no sub-limits, cumulative bonuses and 100% restoration of the Sum Insured, you don’t have to be out of pocket.

Benefit for a healthy mother,a healthy child, Maternal care,Antenatal and postnatal care

To make sure all the bases are covered

AYUSH treatment

Designed for those with active lifestyles

Earn rewards and burn against array of our facilities

The term comprehensive medical insurance is a perfect one for HealthPrime Connect because of the sheer range of features and benefits it offers. Here’s a look at some of the highlights:

1. High Sum Insured:

2. Extensive coverage:

3. Multiple Allowances:

4. Special Expenses:

5. Maternity and childcare expenses

6. Expenses towards special treatments:

7. Wellness benefits:

8. Restoration benefits:

9. Emergency assistance

10. Renewal Benefits: Loyalty is rewarding

11. Optional benefits: (available with Optimum and Optimum Plus): A little extra can go a long way

We have made it easy for you to buy our comprehensive health insurance plans. You can do it from the comfort of your home in just a few clicks by visiting the following link:

https://www.libertyinsurance.in/products/health-insurance/health-insurance-quote

If you are over 18 years and under 65, you are eligible to buy the policy.

Children between 91 days and 25 years can be covered in you’re the comprehensive health insurance plan as dependents

You can include your family either through an individual plan (where there is a fixed Sum Insured for each member) or a floater plan (where one Sum Insured covers the entire family).

In an individual plan, you can include yourself and your spouse, children, parents, parents-in-law, grandchildren and grandparents, siblings, son-in-law and daughter-in-law. You can get a 10% discount on the premium if you add more than two family members.

In a floater, you can add yourself and your spouse, children, parents and parents-in-law with a maximum of two adults and three children

You can opt for cover ranging from Rs 10 lakh to Rs 1 crore based on your needs.

Sub-limits are used to cap specific expenses like room rent or doctor charges. For example, if the sub-limit for room rent is Rs 2000 per day, and you opt for a room with a rent of Rs 2200 per day, you will have to pay Rs 200 out of your pocket. HealthPrime Connect has no sub-limits, and your hospitalisation expenses are fully covered.

Copay is a fixed amount you must pay for any treatment with the rest being paid by the insurance company. HealthPrime Connect has no copay.

We will cover any day procedure which is approved by Indian Medical Association and is not experimental or excluded.

You are eligible for daily cash allowance after the first 48 hours or two days.

Yes, you can pay the premium in easy instalments towards our comprehensive health insurance plans. Here’s how it breaks down:

Yes, HealthPrime Connect covers your medical expenses anywhere in India. You can also opt for worldwide coverage (up to 50% of Sum Insured) under the Optimum and Optimum Plus plans. Global hospitalisation expenses are covered under the following conditions:

Only inpatient hospitalisation expenses are covered, and the policyholder is reimbursed in INR.

Yes, this comprehensive medical insurance policy covers pre-existing conditions. However, pre-existing conditions or any complications arising from them are covered after a continuous period of 36-48 months of policy coverage has elapsed.

You can get covered for obesity treatment (from Rs 3 lakh to Rs 5 lakh) under Optimum and Optimum Plus plans if your BMI is higher than 40 with medical co-morbidities.

You can get an extension of tenure when you are out of the country for a continuous period of 15 days.

Earn and burn is a wellness benefit which helps you earn points by leading a healthier lifestyle. You can use these points towards rewards and discounts.

Claims are processed by an in-house team efficiently and quickly. You can read about our claim process here.

You can opt for add-on covers for critical illness and personal accident by paying an additional premium.

Yes, you can, but only at the time of renewal and if there has been no claim during the year.

You can opt for additional OPD cover from Rs 10,000 to Rs 30,000 under Optimum and Optimum Plus plans.

Maternal and infant care expenses are built-in with Optimum and Optimum Plus comprehensive health insurance plans.

Here are some of the benefits you can claim across all our plans:

Yes. Inpatient expenses towards Ayurveda, Yoga, Naturopathy, Unani, Siddha and Homoeopathy are covered in Optimum and Optimum Plus plans, provided the treatment is taken at a government-recognised or accredited centre.

Yes. You can claim expenses for correction of refractive errors of +/-5 and above as part of the comprehensive health insurance plan.

Any expense incurred to improve your current health condition is covered, including payments towards first medical opinion, fortnightly newsletters, live health talks, etc.

We understand that the last thing you need while filing a claim for medical expenses is red-tape and delays.

That’s why we have designed our processes to be smooth, efficient, quick and straightforward. We have a dedicated in-house team who will assist and process your claims as quickly as possible.

If you are getting treated at one of our network hospitals, your treatment will be cashless, allowing you to focus on the healthcare issue instead of worrying about payment.

When should you register your claim?: Make sure to register your claim at least 48 hours before a planned admission. If it’s an emergency, then let us know within 24 hours of being admitted.

How to file a claim?: Call us on 18002665844 (08:00 AM to 08:00 PM all days a week) or write to us at Health360@LibertyInsurance.In.

How can our team help with your claims?:

- Call up our 24-hour helpline for answers to any queries you may have about your claim

- Seek assistance for cashless service at network hospitals and reimbursement for treatment at non-network hospitals

- Get online help during hospitalisation and filing of claims

Visit https://www.libertyinsurance.in/products/claims/health-claims to check status of your claim.

Disclaimer:

Product Name:-HealthPrime Connect - Liberty General Insurance Limited , Product UIN: LIBHLIP21505V022021.

If you are worried about the growing risk of infectious diseases and lifestyle-related illnesses, and the rapidly rising cost of medical treatment, then...

HealthPrime Connect - Optimum: A comprehensive policy that gives you the perfect mix of coverage and benefits.

You are an achiever who will not settle for second best in anything. Naturally, when it comes to matters of health, you will brook no short-cuts or compromises.

Average RatingBased on 35 Ratings

Liberty General Insurance offers the best health insurance in India. The plans available with the company are so many...

If you are looking for the best health insurance plans in India, I suggest you go for Liberty General Insurance ...

Liberty offers the best health insurance policy in the market in terms of coverage. I did a very thorough...

I was looking for a health policy that would provide coverage for at least 2 years, so that I wouldn’t have to renew...

I wanted an extra health insurance plan, as the insurance cover from my employer wasn’t enough. I looked at a...

Motor insurance covers several type of vehicle including two, three, and four wheelers. Typical Motor Insurance Policies...

In India, medical costs are increasing at the rate of 15-20%. Unhealthy lifestyle habits and an increasing number of diseases are further adding...

Read More

Getting a health insurance for yourself and your family is as important as adopting a healthy lifestyle. Buying a health insurance cover is...

Read More

By now, most of us know that health insurance provides coverage against expenditure caused by a medical emergency. With rising medical care...

Read More

When you are young and healthy, it is common for people to believe that they are fine and won't require any medical attention, at least not ...

Read MoreRegistration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656

2019 Liberty General Insurance Ltd.

Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013

Trade Logo displayed above belongs to Liberty Mutual and used by the Liberty General Insurance Limited under license. For more details on risk factors, terms & conditions please read sales brochure carefully before concluding a sale.